One of the biggest stories in agriculture in 2020 was China’s return to buying U.S. corn – and a lot of it.

The U.S. and Chinese governments signed the Phase One trade deal in mid-January. After the terms took effect one month later, importers were able to obtain exclusions for corn and other agricultural products from retaliatory tariffs imposed on agricultural products in July 2018.

These exclusions made U.S. agricultural products more competitive in the Chinese market. Together with substantial purchases of U.S. sorghum, these sales provided encouragement that U.S. farmers and agribusinesses were seeing results from the agreement with China, in addition to the promised structural changes to provide U.S. products improved access to the Chinese market over the long term.

Also contributing to increased U.S. corn purchases was the fact that China had drawn down its corn reserves – built up between 2012 and 2015 – each summer since 2016, meaning the country had less locally-grown corn to supply to the domestic market.

By the end of the 2019/2020 marketing year, U.S. corn sales to China were booming based on local demand and exceeded marketing year-end exports to that country for the last seven marketing years. This made China the third-largest market for U.S. grains in all forms (GIAF).

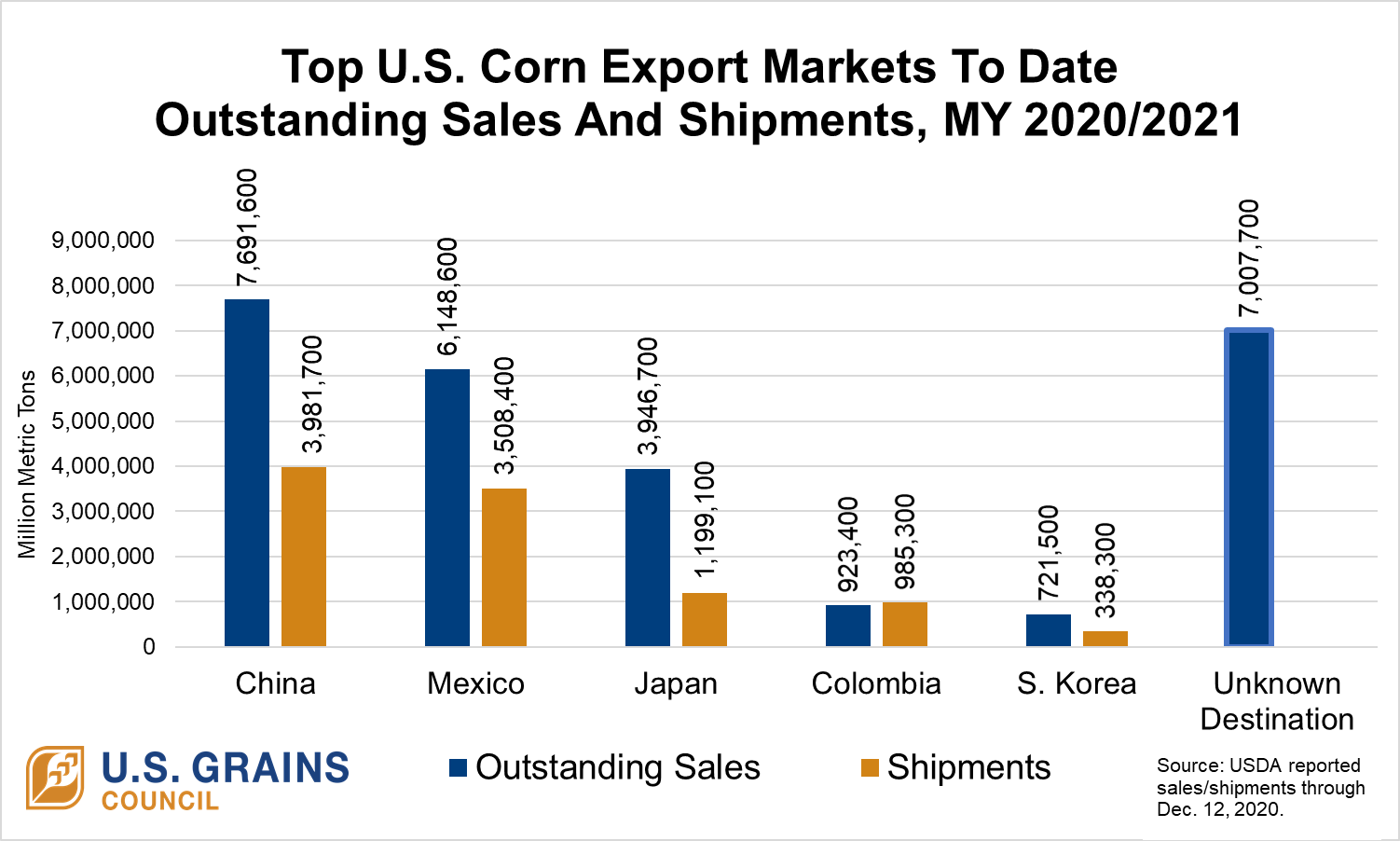

As the 2020/2021 marketing year began in September, the volume of China’s continued purchases landed the country squarely on the books as the largest buyer of U.S. corn.

These purchases lead to a trend of improving grain-product demand from the world’s largest country by population, and they are giving farmers new optimism after a period marked by trade policy challenges, COVID-19-related losses and fledgling global demand.

For more than 35 years, the U.S. Grains Council (USGC) has worked to help customers and other stakeholders in China improve their operations and advance China’s food security, safety and agricultural sustainability through trade. USGC staff continues to regularly interact with Chinese importers even while the global outbreak of COVID-19 has required the Council’s international staff to shift to remote work status and adhere to travel restrictions.

In the coming months, China will likely buy new-crop U.S. corn like it has purchased new-crop U.S. sorghum. That would portend longer-term demand and a solid trading relationship that will continue to contribute positively to U.S. grain markets – and U.S. farmers’ bottom lines.